HEADLINES SELECTED BY INTERCARGO (24/11/2025 – 30/11/2025)

Coal Ship Turns Back After Protesters Block Shipping Channel at Major Australian Port

A climate-change protest off Australia’s coast forced an inbound ship to turn back from one of the country’s largest terminals for coal exports on Saturday, prompting 11 arrests. (gCaptain: click here)

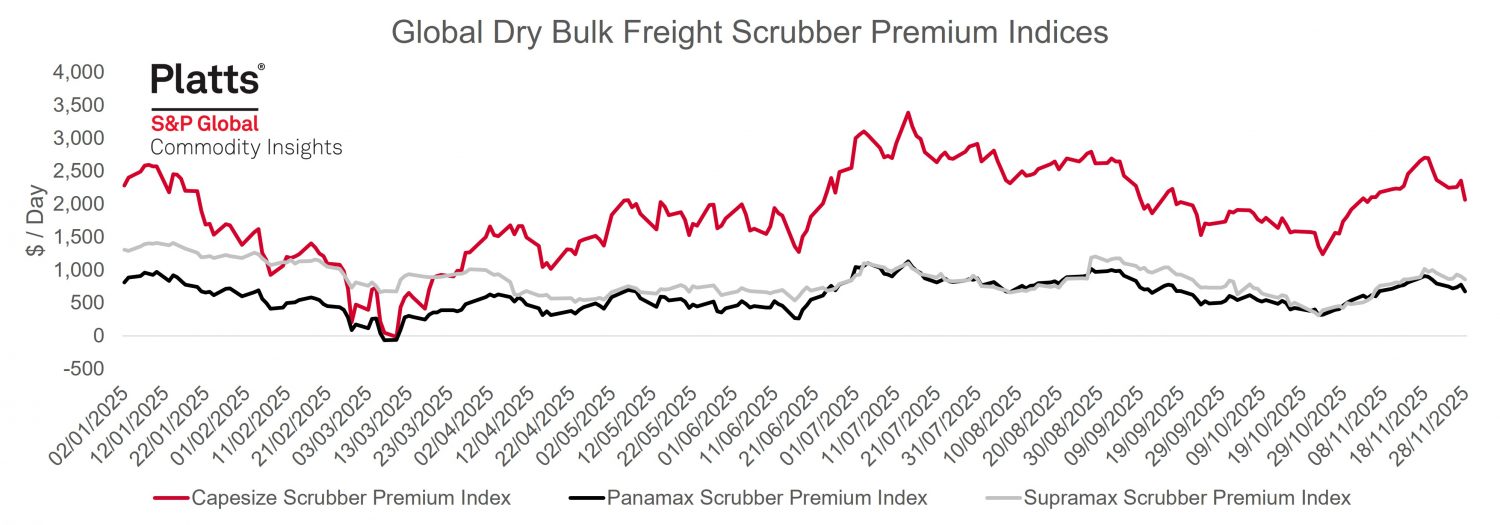

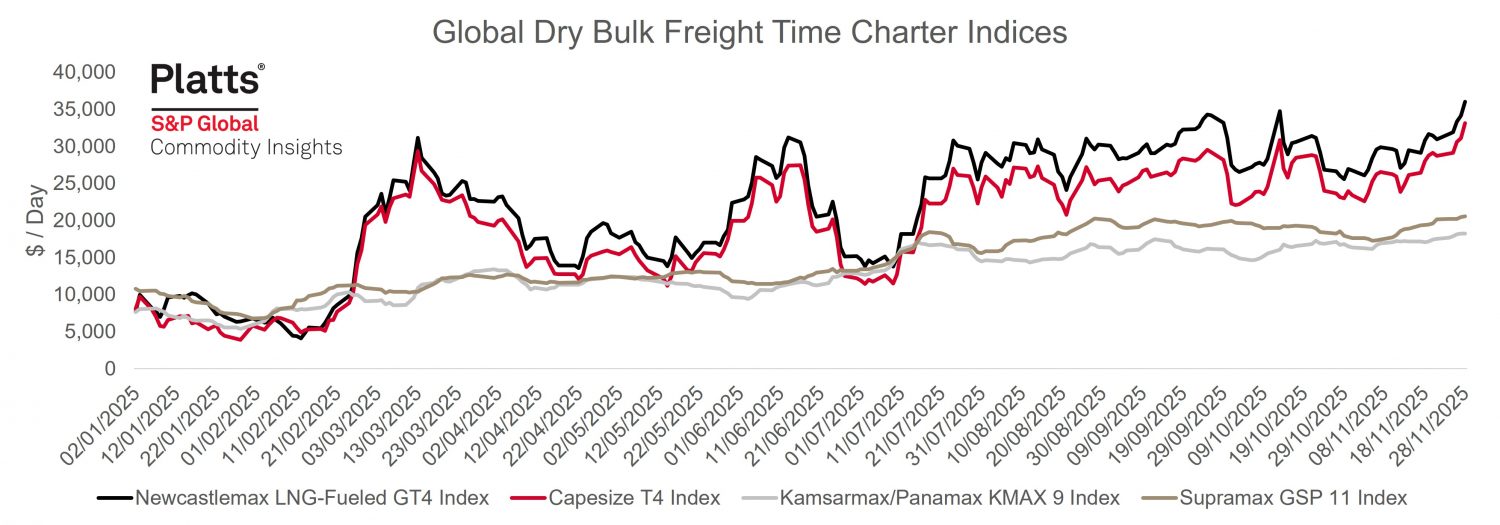

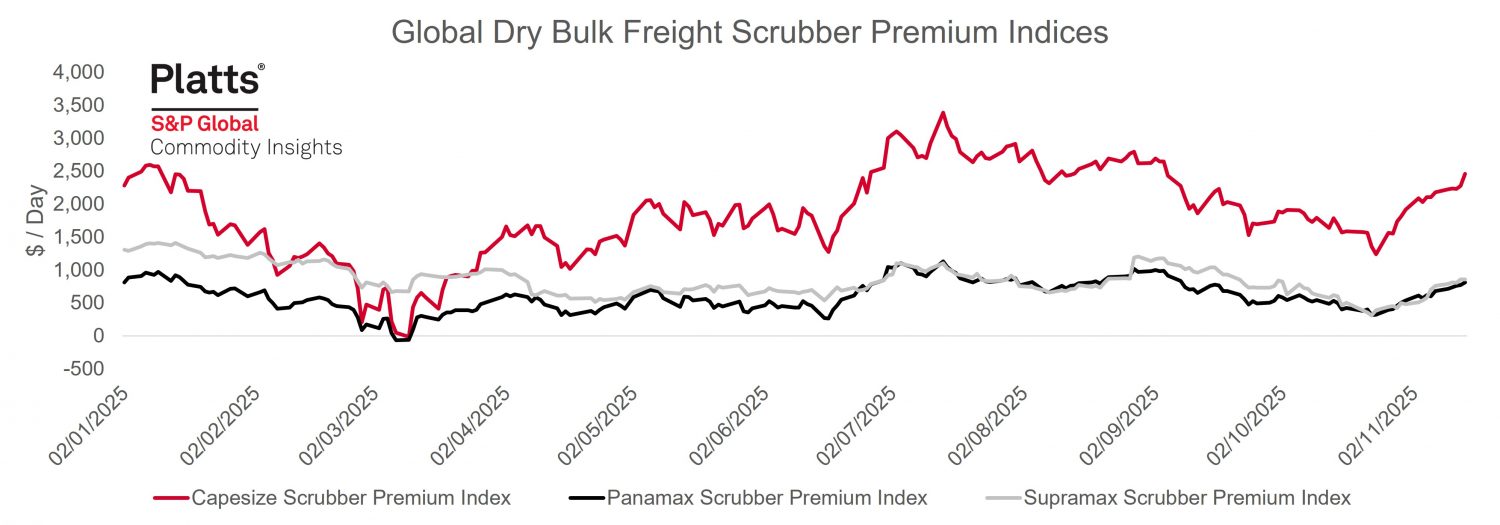

Bulk carrier values hold firm as strong freight rates support market

Mid-sized segments have seen earnings converge recently, narrowing traditional asset value differentials between ultramaxes and kamsarmax bulkers (Lloyd’s List: click here)

Coal shipments down as global steel production falls

Predictions the seaborne coal trade had already peaked may have seemed premature earlier in the year, but the data is showing a steady decline in 2025. (Lloyd’s List: click here)

Iron ore posts third weekly gain on infrastructure demand

Iron ore futures prices dipped on Friday, but logged their third straight weekly gain on recent infrastructure demand… (Hellenic Shipping News Worldwide: click here)

Baltic Dry Index nears two-year high as capesize spot market takes off

Another good day for the capesize spot market has pushed the Baltic Dry Index (BDI) to its highest level in almost two years. (TradeWinds: click here)

Dry market report – Week 48

Capesize: The Capesize market delivered a robust and increasingly confident performance this week…

Panamax: The market held a steady tone through the week, supported by firm fundamentals in the US Gulf and US East Coast… Ultramax/Supramax: A staggered week with the Atlantic seeing a dip in activity with the Thanksgiving period at the end… Handy: The market remained broadly steady this week, with slight gains in some regions and subdued conditions in others… (Baltic Exchange: click here)

|

|

28.11.2025 |

21.11.2025 |

WEEKLY CHANGES |

WEEKLY CHANGE % |

Baltic Dry Index |

2,560 |

2,275 |

+285.0 |

+12.5% |

BRENT ($/bbl) |

63.2 |

62.6 |

+0.6 |

+1.0% |

WTI ($/bbl) |

58.6 |

58.1 |

+0.5 |

+0.8% |

MGO ROTTERDAM ($/mt) |

660.5 |

721.5 |

-61.0 |

-8.5% |

MGO FUJAIRAH ($/mt) |

714.5 |

730.0 |

-15.5 |

-2.1% |

MGO SINGAPORE ($/mt) |

672.0 |

734.5 |

-62.5 |

-8.5% |

VLSFO ROTTERDAM ($/mt) |

407.0 |

415.5 |

-8.5 |

-2.0% |

VLSFO FUJAIRAH ($/mt) |

431.5 |

443.0 |

-11.5 |

-2.6% |

VLSFO SINGAPORE ($/mt) |

437.5 |

450.0 |

-12.5 |

-2.8% |

IFO 380 ROTTERDAM ($/mt) |

365.5 |

359.0 |

+6.5 |

+1.8% |

IFO 380 FUJAIRAH ($/mt) |

324.5 |

332.0 |

-7.5 |

-2.3% |

IFO 380 SINGAPORE ($/mt) |

356.5 |

361.5 |

-5.0 |

-1.4% |

LSMGO ROTTERDAM, MAX 0.1% SULFUR DISTILLATE ($/mt) |

660.5 |

721.5 |

-61.0 |

-8.5% |

LSMGO SINGAPORE, MAX 0.1% SULFUR DISTILLATE ($/mt) |

672.0 |

734.5 |

-62.5 |

-8.5% |

Biofuel ROTTERDAM (B30) |

700.0 |

711.0 |

-11.0 |

-1.5% |

Biofuel FUJAIRAH (B30) |

662.0 |

676.5 |

-14.5 |

-2.1% |

Biofuel SINGAPORE (B24) |

661.0 |

674.5 |

-13.5 |

-2.0% |

EU Emissions Allowance (EUR) |

82.8 |

80.5 |

+2.3 |

+2.8% |

EUR-USD |

1.16 |

1.15 |

+0.01 |

+0.6% |

GBP-USD |

1.32 |

1.31 |

+0.01 |

+1.1% |

USD-JPY |

156.28 |

156.38 |

-0.10 |

-0.1% |

USD-KRW |

1,469.0 |

1,470.0 |

-1.00 |

-0.1% |

Sources: Cnbc.com, ShipandBunker.com, Exchangerates.org.uk |

||||

HEADLINES SELECTED BY INTERCARGO (01/11/2025 – 16/11/2025)

Black Sea threat level red

The Black Sea has entered one of its most volatile phases as Ukraine and Russia escalate long-range strikes on each other’s critical energy and port infrastructure, leaving commercial shipping exposed to huge levels of risk. (Splash 247: click here)

‘Massive’ Ukrainian drone attack on Russian Black Sea port leaves three seafarers injured

Three seafarers on a merchant ship docked in Novorossiysk were injured after Ukraine sent dozens of drones to attack the major Russian Black Sea port early on Friday. (TradeWinds: click here)

Operation Atalanta liberates pirate mothership

The move represents a show of force from navies in the region, despite the delay in attending the scene; but landside factors mean Somali piracy is likely to remain a risk factor (Lloyd’s List: click here)

Houthis Announce End of Red Sea Shipping Attacks

In a significant change in direction, the rebel Houthi leadership in Yemen have declared that they will bring to an end their declared campaign against maritime interests connected to Israel. (The Maritime Executive: click here)

Chinese iron ore inventories rise as imports jump 7%

“Iron ore shipments to China have risen 7% y/y since the end of June, following a stable period during the first half of the year. However, Chinese steel production has remained weak …” (Dry Cargo Int’l: click here)

Guinea’s Giant Iron Ore Mine Begins Loading its First Shipment

The largest new iron ore mining project in years, Simandou, has just dispatched its first ore shipment. (The Maritime Executive: click here)

Grain and soya trade pickup expected

Support for commodity import demand in a range of countries seems to be improving based on recent signs. Nevertheless weakening influences elsewhere are still prominent, suggesting that world seaborne dry bulk trade growth may be minimal or nil in 2025 as a whole and some restraints may continue into next year. (Dry Cargo Int’l: click here)

China’s copper exports boom on rising arbitrage, supply

Chinese copper exports are on pace to set a record in 2025, with October shipments set to exceed 100,000 metric tons for only the third time ever… (Hellenic Shipping News Worldwide: click here)

Dry market report – Week 46

Capesize: The Capesize market followed a generally softer trajectory for much of the week, with sentiment steadily eroding through the first half… Panamax: The week returned a mixed feel for the Panamax market. The North Atlantic market lacked any depth with limited information surfacing… Ultramax/Supramax: The market witnessed strong momentum and busy activity this week. Activity increased significantly from the U.S. Gulf… Handy: The Handysize market experienced a largely steady yet mixed week, fluctuating between cautious optimism and mild softness… (Baltic Exchange: click here)

|

|

14.11.2025 |

07.11.2025 |

WEEKLY CHANGES |

WEEKLY CHANGE % |

Baltic Dry Index |

2,125 |

2,104 |

+21.0 |

+1.0% |

BRENT ($/bbl) |

64.4 |

63.6 |

+0.8 |

+1.2% |

WTI ($/bbl) |

60.1 |

59.8 |

+0.3 |

+0.6% |

MGO ROTTERDAM ($/mt) |

723.5 |

720.5 |

+3.0 |

+0.4% |

MGO FUJAIRAH ($/mt) |

740.5 |

744.5 |

-4.0 |

-0.5% |

MGO SINGAPORE ($/mt) |

739.0 |

751.0 |

-12.0 |

-1.6% |

VLSFO ROTTERDAM ($/mt) |

433.0 |

435.5 |

-2.5 |

-0.6% |

VLSFO FUJAIRAH ($/mt) |

458.0 |

463.5 |

-5.5 |

-1.2% |

VLSFO SINGAPORE ($/mt) |

461.0 |

465.0 |

-4.0 |

-0.9% |

IFO 380 ROTTERDAM ($/mt) |

383.0 |

400.0 |

-17.0 |

-4.3% |

IFO 380 FUJAIRAH ($/mt) |

346.5 |

359.0 |

-12.5 |

-3.5% |

IFO 380 SINGAPORE ($/mt) |

375.5 |

385.5 |

-10.0 |

-2.6% |

LSMGO ROTTERDAM, MAX 0.1% SULFUR DISTILLATE ($/mt) |

723.5 |

720.5 |

+3.0 |

+0.4% |

LSMGO SINGAPORE, MAX 0.1% SULFUR DISTILLATE ($/mt) |

739.0 |

751.0 |

-12.0 |

-1.6% |

Biofuel ROTTERDAM (B30) |

722.0 |

713.0 |

+9.0 |

+1.3% |

Biofuel FUJAIRAH (B30) |

682.0 |

687.0 |

-5.0 |

-0.7% |

Biofuel SINGAPORE (B24) |

680.5 |

675.0 |

+5.5 |

+0.8% |

EU Emissions Allowance (EUR) |

81.0 |

80.1 |

+1.0 |

+1.2% |

EUR-USD |

1.16 |

1.16 |

+0.01 |

+0.5% |

GBP-USD |

1.32 |

1.32 |

0.00 |

0.0% |

USD-JPY |

154.52 |

153.54 |

+0.98 |

+0.6% |

USD-KRW |

1,449.0 |

1,456.0 |

-7.00 |

-0.5% |

Sources: Cnbc.com, ShipandBunker.com, Exchangerates.org.uk |

||||

HEADLINES SELECTED BY INTERCARGO (01/10/2025 – 20/10/2025)

IMO fracture deepens global climate fault lines in shipping

Shipping historians covering the International Maritime Organisation (IMO) would need to go back more than 40 years to a comparable setback to what played out on Friday and the downing of the Net-Zero Framework (NZF). (Splash 247: click here)

IMO Adjourns, Industry Responds

With negotiations on the International Maritime Organization’s Net-Zero Framework now deferred for a year, the industry is expressing frustration at the delay — but also calling for this pause to be used productively to build consensus and carve out practical, globally-applicable decarbonisation solutions (MarineLink: click here)

Safety failings exposed after seafarer falls through crane cabin floor

An investigation has highlighted a series of safety failings after a seafarer died when he fell through the glass floor of a crane cabin on a bulker during routine cleaning. (TradeWinds: click here)

Seafarer dies after falling overboard from Isle of Man-flagged vessel

The seafarer fell from a BW Group bulker World Prize three nautical miles east of the port of Ronnskar on Tuesday while preparing for the pilot’s departure. An investigation is underway after a seafarer died after falling overboard an Isle of Man-flagged vessel. (Isle of Man Today: click here)

Mauritius Cites Lack of Safety Culture and Local Failure in Wakashio Report

The Court of Investigation convened by Mauritius released a new report into the 2020 casualty of the bulker Wakashio, which broke apart after grounding and caused significant environmental damage. (The Maritime Executive: click here)

China holds off on soybean purchases due to high Brazil premiums, traders say

China has yet to secure much of its soybean supply for December and January as high premiums for Brazilian cargoes discourage buyers, a development that could prompt Beijing to tap state reserves to meet near-term needs, three trade sources said. (Hellenic Shipping News Worldwide: click here)

Bauxite steals iron ore’s thunder

Iron ore continues to dominate global dry bulk tonne-mile generation, though its relative weight has steadily declined over the past decade, from 41.5% in 2015 to a low of 36.2% in 2024, and to around 37.1% in 2025 year to date… (Splash 247: click here)

Baltic index logs weekly gain as all vessels segments rise in tandem

The Baltic Exchange’s dry bulk sea freight index, which monitors rates for vessels moving dry bulk commodities, rose on Friday and posted a weekly gain … (Hellenic Shipping News Worldwide: click here)

Dry market report – Week 42

Capesize: The Capesize market experienced a volatile week marked by sharp swings in sentiment and rates following China’s announcement… Panamax: The USA v China trade/tariff speculation early part curtailed activity with most players holding off trying to work out full implications… Ultramax/Supramax: After the previous week’s widespread holidays, it was a slightly more positive affair for the sector… Handy: Overall, the market remained steady and relatively balanced throughout the week. In the Continent and Mediterranean… (Baltic Exchange: click here)

|

|

17.10.2025 |

10.10.2025 |

WEEKLY CHANGES |

WEEKLY CHANGE % |

Baltic Dry Index |

2,069 |

1,936 |

+133.0 |

+6.9% |

BRENT ($/bbl) |

61.3 |

62.7 |

-1.4 |

-2.3% |

WTI ($/bbl) |

57.5 |

58.9 |

-1.4 |

-2.3% |

MGO ROTTERDAM ($/mt) |

639.5 |

670.0 |

-30.5 |

-4.6% |

MGO FUJAIRAH ($/mt) |

720.5 |

733.5 |

-13.0 |

-1.8% |

MGO SINGAPORE ($/mt) |

656.5 |

674.5 |

-18.0 |

-2.7% |

VLSFO ROTTERDAM ($/mt) |

424.0 |

443.0 |

-19.0 |

-4.3% |

VLSFO FUJAIRAH ($/mt) |

437.0 |

474.0 |

-37.0 |

-7.8% |

VLSFO SINGAPORE ($/mt) |

443.0 |

470.0 |

-27.0 |

-5.7% |

IFO 380 ROTTERDAM ($/mt) |

395.0 |

408.5 |

-13.5 |

-3.3% |

IFO 380 FUJAIRAH ($/mt) |

377.0 |

411.5 |

-34.5 |

-8.4% |

IFO 380 SINGAPORE ($/mt) |

381.5 |

401.5 |

-20.0 |

-5.0% |

LSMGO ROTTERDAM, MAX 0.1% SULFUR DISTILLATE ($/mt) |

639.5 |

670.0 |

-30.5 |

-4.6% |

LSMGO SINGAPORE, MAX 0.1% SULFUR DISTILLATE ($/mt) |

656.5 |

674.5 |

-18.0 |

-2.7% |

Biofuel ROTTERDAM (B30) |

722.0 |

747.0 |

-25.0 |

-3.3% |

Biofuel FUJAIRAH (B30) |

653.0 |

689.5 |

-36.5 |

-5.3% |

Biofuel SINGAPORE (B24) |

662.0 |

688.5 |

-26.5 |

-3.8% |

EU Emissions Allowance (EUR) |

79.0 |

79.7 |

-0.7 |

-0.9% |

EUR-USD |

1.17 |

1.16 |

0.00 |

+0.3% |

GBP-USD |

1.34 |

1.34 |

+0.01 |

+0.6% |

USD-JPY |

150.62 |

151.19 |

-0.57 |

-0.4% |

USD-KRW |

1,422.00 |

1,429.00 |

-7.00 |

-0.5% |

Sources: Cnbc.com, ShipandBunker.com, Exchangerates.org.uk |

||||